Why is Facebook worth $104bn?

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report to Moderator

- Plusnet Community

- :

- Plusnet Blogs

- :

- Why is Facebook worth $104bn?

Why is Facebook worth $104bn?

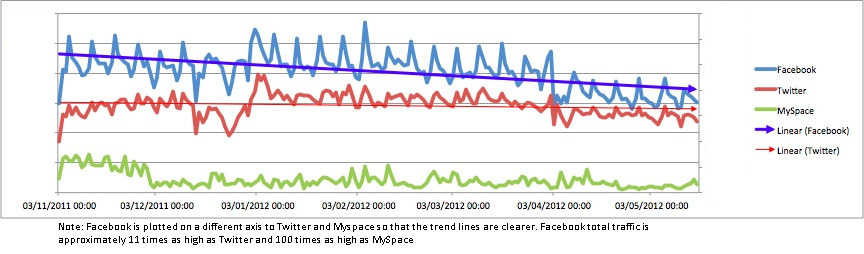

The Facebook IPO has valued it at $104bn or $38 per share. With revenue this year expected to be in the $5bn ball park why is the company worth $100bn? Users don't pay to use Facebook, and it's splashed across their frontpage that they never will; most of the revenue comes from advertising and some from Facebook credits. Quite simply they have a database like no-one else. Tesco's Clubcard database knows exactly what groceries millions of people buy each week but the Facebook database contains so much more. It knows who you know, what you like, what you are doing, who you talk to and so much more. At a valuation of $104bn Facebook's shareholders are going to demand a return on investment which is going to entail a big increase on their revenues. $5bn is going to have to turn in to $30bn to $50bn. At present that revenue works out at just over $5 per user and $1 of profit per year. You can see how much you are worth to Facebook here. Most people are going to be worth more than the $5 they contribute. They therefore either need to massively increase the number of users or massively increase the revenue per user. If you live in Europe or North America and aren't on Facebook then chances are you don't want to be (or can't). There are areas of the world they can grow like China but chances are they are going to have grow most of the revenue from the existing users. Interestingly we're noticing a decrease in traffic to Facebook, there's a step up at the new year and then a step down at Easter. True, a large percentage of the traffic is going to be over the mobile networks, especially if people are out more but the trend on Twitter isn't as pronounced at Easter. MySpace only registers. But what if the mobile networks haven't seen that step down balance out, are people spending less time on Facebook? Some interesting stats from Alexa says the number of search engine searches for Facebook, and the time on site per user is decreasing slightly.

The Facebook IPO has valued it at $104bn or $38 per share. With revenue this year expected to be in the $5bn ball park why is the company worth $100bn? Users don't pay to use Facebook, and it's splashed across their frontpage that they never will; most of the revenue comes from advertising and some from Facebook credits. Quite simply they have a database like no-one else. Tesco's Clubcard database knows exactly what groceries millions of people buy each week but the Facebook database contains so much more. It knows who you know, what you like, what you are doing, who you talk to and so much more. At a valuation of $104bn Facebook's shareholders are going to demand a return on investment which is going to entail a big increase on their revenues. $5bn is going to have to turn in to $30bn to $50bn. At present that revenue works out at just over $5 per user and $1 of profit per year. You can see how much you are worth to Facebook here. Most people are going to be worth more than the $5 they contribute. They therefore either need to massively increase the number of users or massively increase the revenue per user. If you live in Europe or North America and aren't on Facebook then chances are you don't want to be (or can't). There are areas of the world they can grow like China but chances are they are going to have grow most of the revenue from the existing users. Interestingly we're noticing a decrease in traffic to Facebook, there's a step up at the new year and then a step down at Easter. True, a large percentage of the traffic is going to be over the mobile networks, especially if people are out more but the trend on Twitter isn't as pronounced at Easter. MySpace only registers. But what if the mobile networks haven't seen that step down balance out, are people spending less time on Facebook? Some interesting stats from Alexa says the number of search engine searches for Facebook, and the time on site per user is decreasing slightly.  That's going to mean more targeted adverts, more emphasis on mobile revenue and more chargeable content. They will have to exploit their database in more ways to maximise the value of those targeted adverts. For example, if you "like" Dell and post on your status that your laptop has been stolen, you can imagine the adverts they are likely to serve up. Or if you have Netflix feeding in that you like lots of Arnie films, what advert will you get when his new movie comes out? Will the advertisers be willing to pay for these premium targeted ads and will the users put up with more ads and will they pay for the extra content? GM have already walked away from a $40m advertising spend saying it hasn't worked for them. Will Instagram's $1bn purchase help? We shall see. Ten years ago everyone flocked to Friends Reunited, then MySpace, but where are these services today? Facebook won't want to be another footnote in the dotcom world and that certainly won't be what the shareholders want, but there's always a danger that if you try and over monitise your customer base they will leave. A business with $5bn on revenues and a billion in profit after 8 years is an amazing success story. But having to turn that into $40bn will be interesting. Dave Tomlinson Plusnet Product Team About the author: Dave Tomlinson has worked in the ISP industry for over 12 years, the last 9 at Plusnet. This blog represents a personal opinion and does not necessarily reflect the views of Plusnet.

That's going to mean more targeted adverts, more emphasis on mobile revenue and more chargeable content. They will have to exploit their database in more ways to maximise the value of those targeted adverts. For example, if you "like" Dell and post on your status that your laptop has been stolen, you can imagine the adverts they are likely to serve up. Or if you have Netflix feeding in that you like lots of Arnie films, what advert will you get when his new movie comes out? Will the advertisers be willing to pay for these premium targeted ads and will the users put up with more ads and will they pay for the extra content? GM have already walked away from a $40m advertising spend saying it hasn't worked for them. Will Instagram's $1bn purchase help? We shall see. Ten years ago everyone flocked to Friends Reunited, then MySpace, but where are these services today? Facebook won't want to be another footnote in the dotcom world and that certainly won't be what the shareholders want, but there's always a danger that if you try and over monitise your customer base they will leave. A business with $5bn on revenues and a billion in profit after 8 years is an amazing success story. But having to turn that into $40bn will be interesting. Dave Tomlinson Plusnet Product Team About the author: Dave Tomlinson has worked in the ISP industry for over 12 years, the last 9 at Plusnet. This blog represents a personal opinion and does not necessarily reflect the views of Plusnet.

- Tags: